Incentives

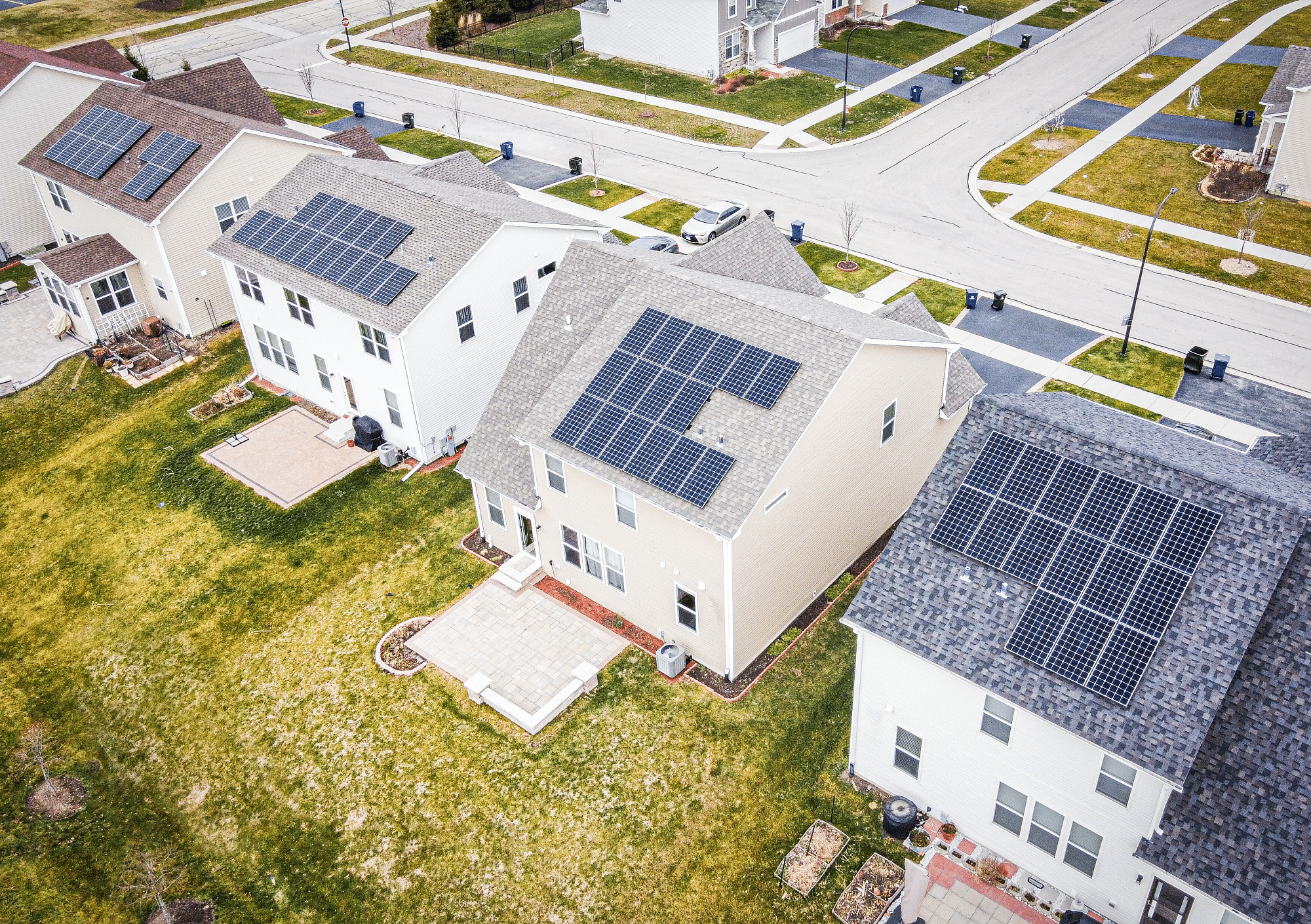

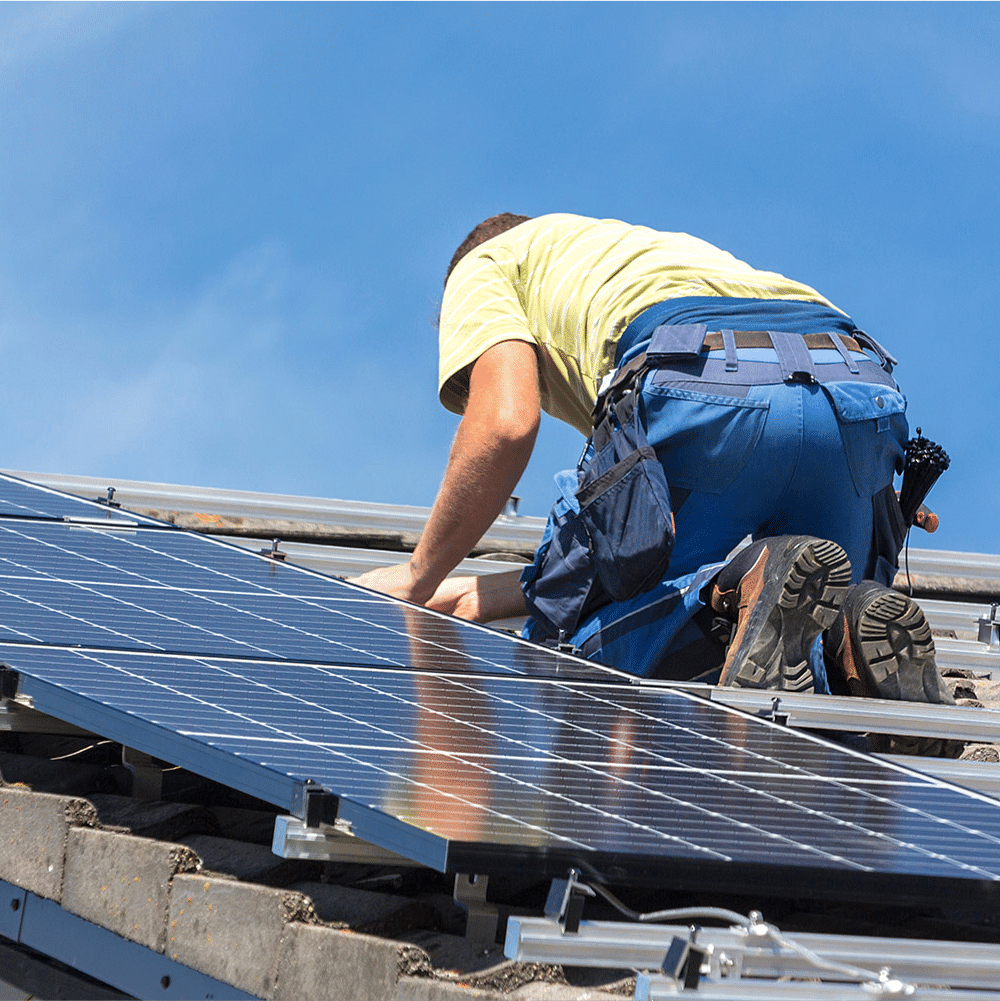

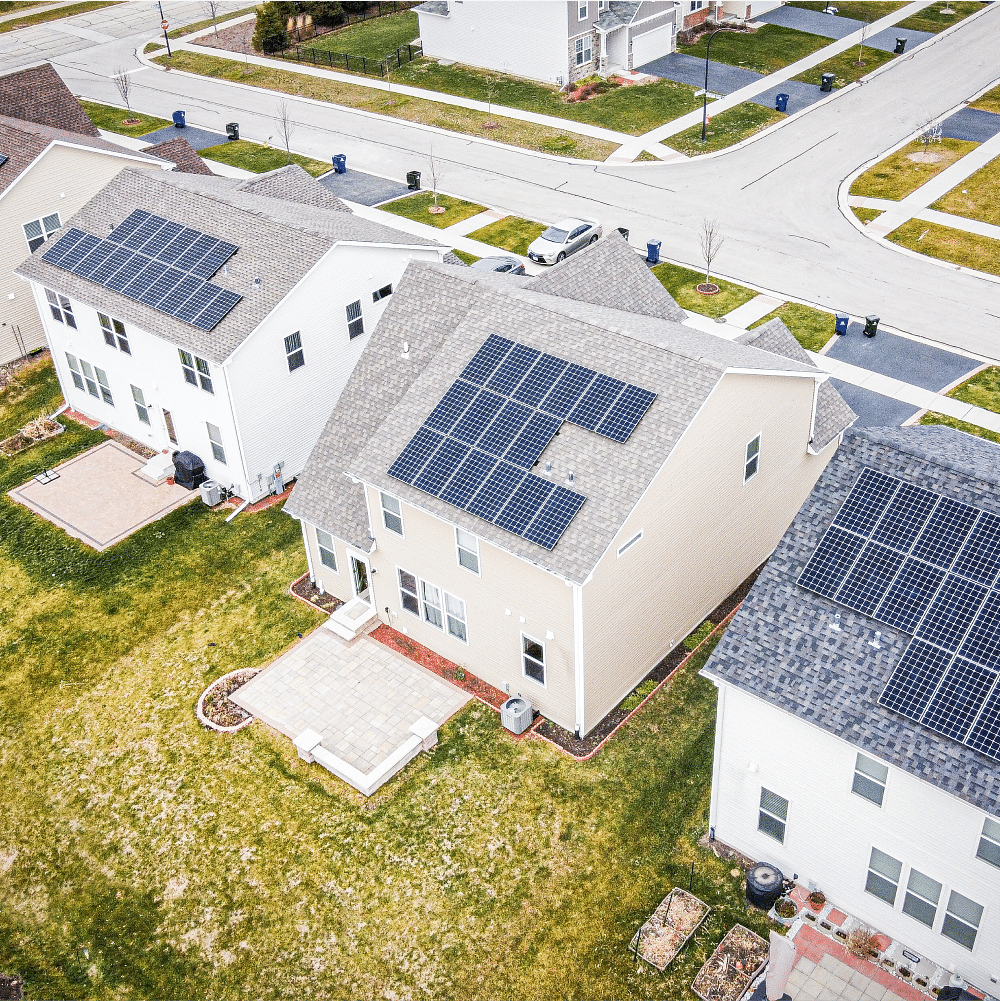

Did you know Illinois currently has some of the best incentives in the country right now? New legislation in 2022 made solar more accessible than ever. Solar doesn't work for everyone, but If you live in Illinois and own your home we would talk to you about how you could save money by creating your own solar energy!

Illinois Shines

Illinois Shines is the brand name for the Adjustable Block Program, a program developed and managed by the Illinois Power Agency that supports the development of solar in Illinois.

Solar Investment Tax Credit

The ITC is a 30% Tax Credit for individuals installing solar systems on residential property (under Section 25D of the tax code). This credit has helped the industry grow dramatically.

Net Metering

Under current Illinois law full retail net metering will go away when the utility reaches 5% adoption. Get into retail net metering while you still can!

Span Panel

Get energy insights sent directly to your phone, while managing every circuit in your home. Span's innovative monitoring system allows your home battery to last up to 40% longer on average.

Receive actionable insights into your home’s energy usage

Circuit-level control from anywhere with the SPAN Home app

Financing

If you’re looking to join the solar energy revolution, you don’t need to be stopped by the costs of solar panels. Installing solar around Illinois is made possible with the help of many federal, state, and local initiatives that help lower costs along with 93 Energy’s financing opportunities. Over the long run, you’ll save more money even when choosing to finance solar panels in your area since the cost of other energy sources continues to balloon. If you’re curious about our solar financing opportunities, see what’s available to you here.

Bridge Loans

Bridge loans are a type of solar loan popular with customers who want to own their system but who need to manage the timing difference between installation and receipt of state and federal incentives. Since solar incentives in Illinois can account for more than 60% of the cost of a system, this type of loan allows customers to go solar with considerably less up-front investment.

Term Loans

A term loan is similar to mortgage. The term loans most frequently chosen by our customers have a 20-year term, but we also offer 15 and 10 year loans. This type of solar loan is great for customers who want to minimize the out-of-pocket cost of going solar but who still want to take advantage of the long-term economics of solar ownership. The payments on these loans can be smaller than the savings on utility bills that result from going solar. We currently offer $0 out-of-pocket for 12 months for qualified buyers!