Why Go Solar with 93Energy?

Slash Operating Costs

Reduce your utility bills and lock in predictable energy rates for 25+ years.

Maximize Incentives

We help you capture every available dollar—from the 30% Federal Investment Tax Credit (ITC) to Illinois Shines and ComEd rebates.

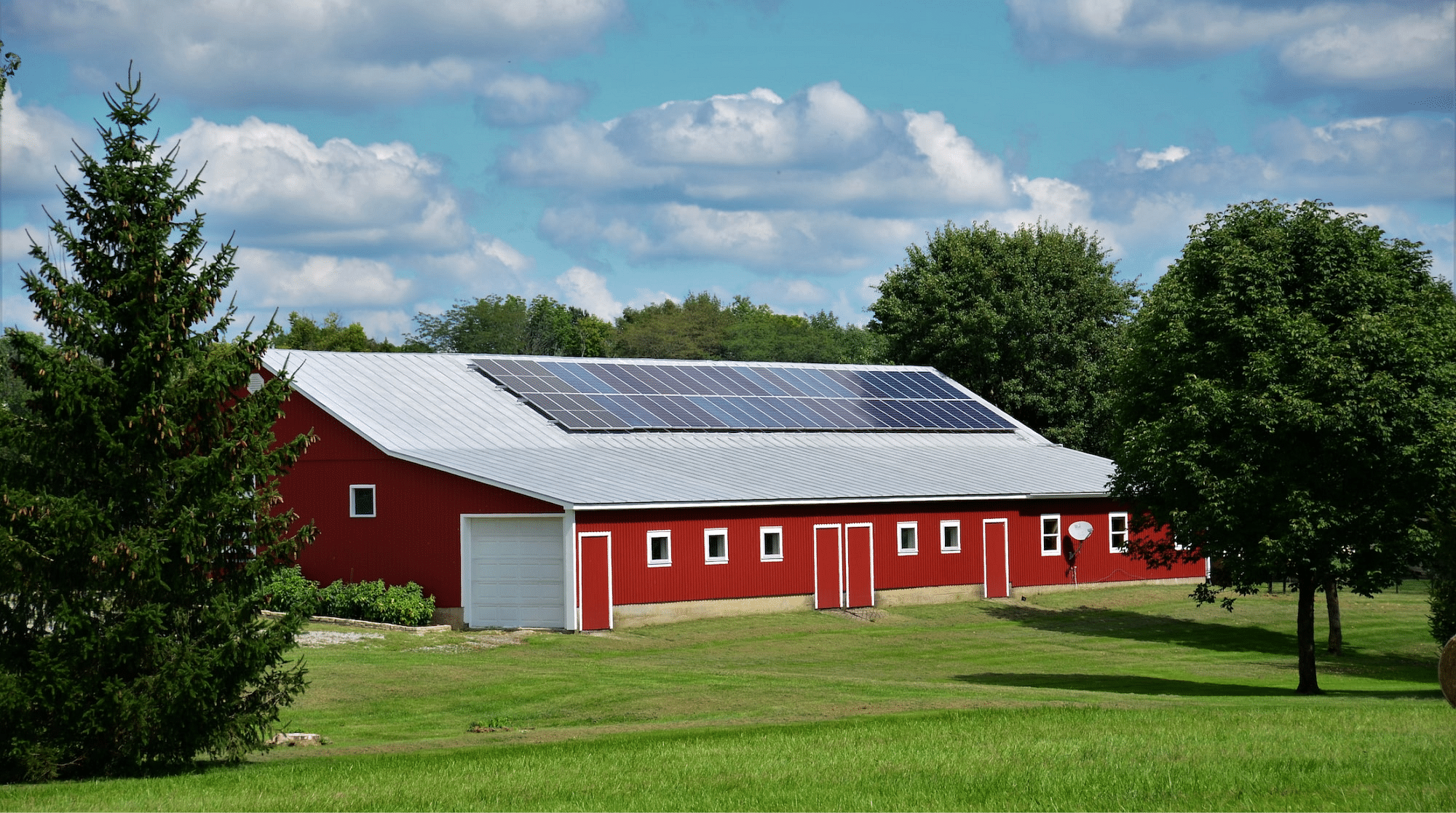

Boost Your Brand Image

Show customers, investors, and your community that your business is leading the charge toward sustainability.

Own Your Power

Generate your own clean electricity and reduce reliance on volatile fossil fuel markets or utility rate hikes.

Low-Maintenance, High Return

Our solar systems are built to last, with minimal maintenance and strong warranties, giving you reliable performance for decades.