The Sustainable Energy Solution

Harvest More With Solar

Make The Sun Work For You

- Save REAL money on your monthly energy bills.

- Reduced up front cost with USDA REAP grants

- 30 Year Warranty

- Solar is more reliable than ever

- Produce savings even in the cold winter months

93Energy knows the value of solar power for farmers just as we understand the value of farmers for America. If you’re ready to move your agricultural operation off the grid and onto reliable, renewable energy, we’re the folks to get you there. Reach out via phone or email to learn more about our agricultural solar installation services today!

Save With Solar

There are a number of ways to get ahead with Agricultural Solar. Here are some ways to save or sell extra energy made from your solar system.

Battery Storage

For short term energy storage, Battery Storage can help store excess energy produced during the day for use in off hours. If your area doesn't support Net Metering, Battery Storage is a reliable way to make sure you can use the energy your system produces.

SRECs

Solar Renewable Energy Certificates allow you to sell your unused energy to business's at a profit to you. Many business's want to market that a portion of the energy they use is from renewable energy. Check to see if your local area has an SREC market.

Solar Incentives

Solar Incentives for Agriculture

State Incentives

Illinois Shines

Illinois Shines is the brand name for the Adjustable Block Program, a program developed and managed by the Illinois Power Agency that supports the development of solar in Illinois.

MACRS

Modified Accelerated Cost Recovery System

The Modified Accelerated Cost Recovery System (MACRS) is a method of depreciation in which a business' investments in certain tangible property are recovered, for tax purposes, over a specified time period through annual deductions.

ITC

Solar Investment Tax Credit

The ITC is a 30% Tax Credit for individuals installing solar systems on commercial property (under Section 48 of the tax code). This credit has helped the industry grow dramatically.

DG

ComEd DG Rebate

ComEd offers a Distributed Generation (DG) Rebate program to help you offset the out-of-pocket costs of installing a qualified renewable energy generating system.

USDA REAP

USDA REAP Solar Grants

Guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make energy efficiency improvements. USDA Reap Solar Grant provides up to 50% of project cost for rural & agricultural projects.

More information on Solar Energy for Agriculture Businesses

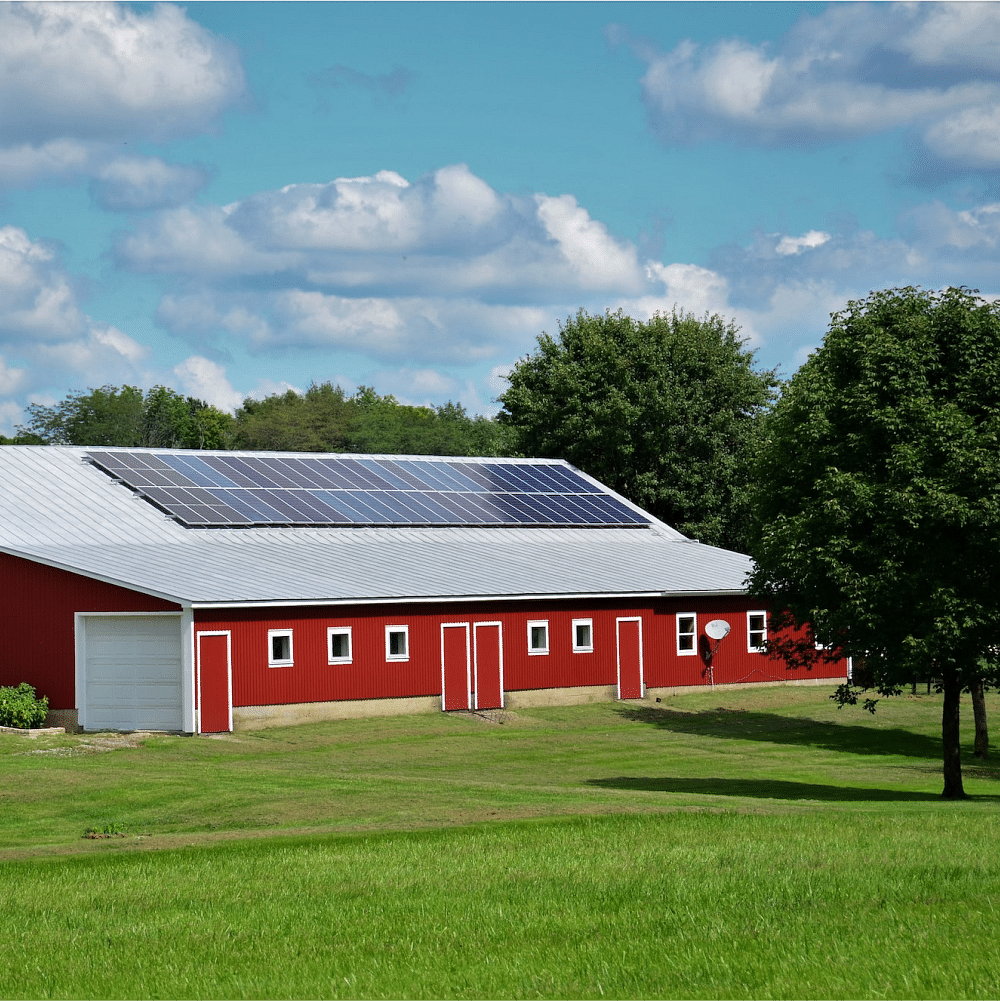

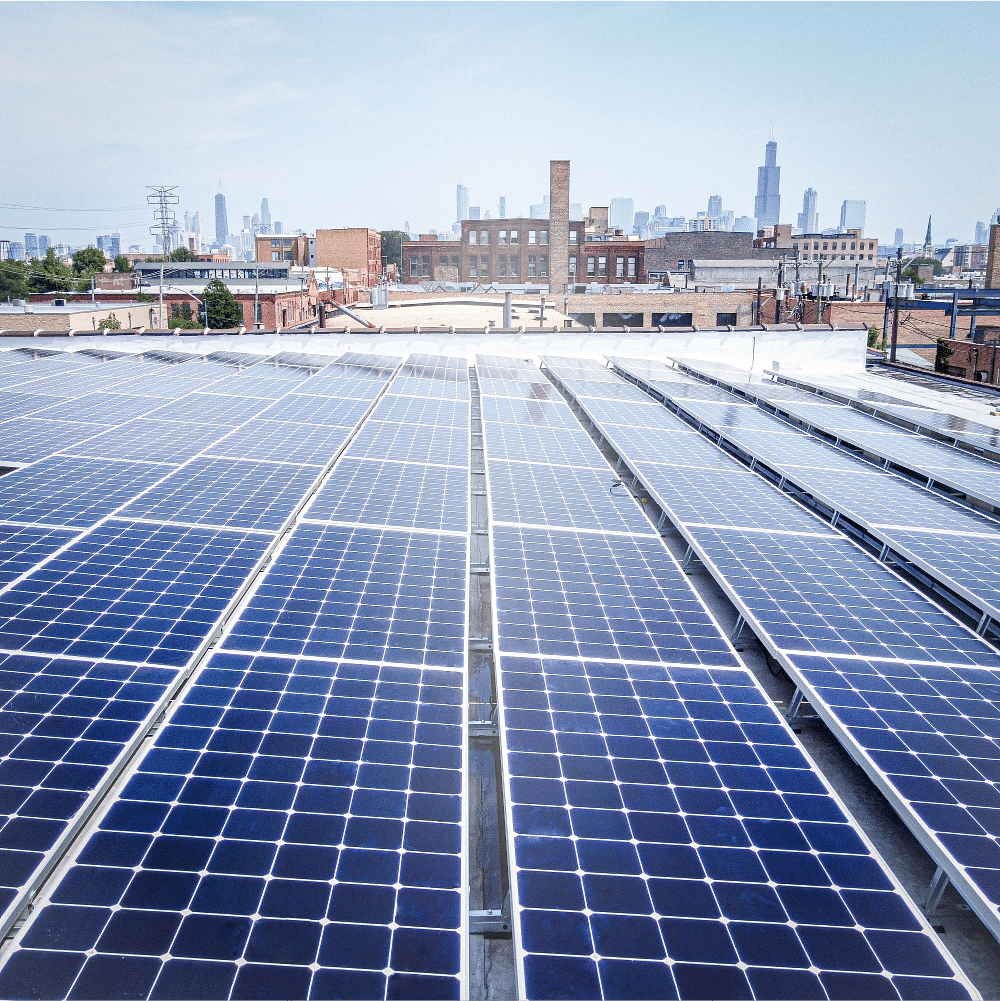

Solar for farmers has become a rapidly growing sector thanks to its efficiency. As government and local programs incentivize solar for farmers more than ever before, and solar technology has only become more efficient, agricultural businesses choose to switch over. Large buildings with open roof space, on-site manufacturing and crop processing, and more benefit from a localized solar installation that frees operations from the grid.

Solar systems installed for high electrical farm usage are one of the best ways to save money in the long run while going green. Solar power for reliable cold storage is possible thanks to the increasingly-efficient technologies that allow for off-grid cold storage on industrial levels. Buildings that have plenty of open roof space that perform cold storage are ideal for installing solar panels for farmers.

Is solar energy soil-friendly? Silicon-based PV cells are the most commonly used photovoltaic technology. Glass paneling on solar modules protects the PV cells along with aluminum steel framing. Solar panels will not emit or leech anything toxic into the soil during normal operation or even during fires. In order to melt the internal components, it would require a fire of industrial temperatures far exceeding anything that a grass fire could hope to create.

Solar panels on a farm will not cause a spread of fungus or offer safe harborage for invasive species. There have been zero studies linking solar development in agriculture to the spread of pets to plant-killing diseases. On the contrary, solar panels help native plants thrive. Air and water conditions under solar installations are similar to those under the sun. Solar panels installed on buildings with wide-open rooftops will not be harborage for pests either when installed by a professional solar company nearby.

No, solar modules won’t heat up or dry out crops growing under or around them. Instead, they’ll cool the plants in harsh sunlight while also keeping them warmer at night. Studies have shown this temperature homeostasis to be beneficial for growing plants quickly and healthily, just as if they were in regular sunlight under ideal conditions. Furthermore, shade-tolerant crops for farming love solar panels since they offer an extended growing season for them and reduce water requirements.

Yes, some animals can graze normally under solar modules, but there are options available if the goal is to keep larger animals away that might be deemed risks. Smaller animals, like foxes, can also be accounted for during fencing construction. The space beneath the solar panels can be reseeded and provide habitats for pollinators, helpful birds, and other small species.

Yes, some livestock can safely graze underneath solar modules without worry. Sheep are commonly employed in vegetation control and can be seen grazing under solar facilities that don’t even grow crops to prevent the overgrowth of local flora. However, larger livestock like cattle might not be compatible due to their size. You will need to discuss with your agricultural solar installation service the best solution for your grazing cattle around solar panels.

Yes, you can safely spray around solar modules with herbicides and fungicides to control weed growth. Agrochemicals will not present an issue with your solar installation.

Farmers often wonder if solar energy can power their irrigation systems. Thankfully, the answer is yes, since solar energy offsets the power needed for pumping water. Solar energy can also provide irrigation to remote areas of land in this way, as it requires no grid connection. Farmers looking to put buildings for manufacturing or cold storage in distant areas of the property will benefit more from choosing solar than paying to expand their electrical grid.

If your farm floods in the spring, all electrical equipment needs to be installed above the projected level of flooding. Areas that see a lot of flooding might not be as economically viable for solar installations due to the increased installation costs of elevating the technologies. However, solar modules on farms can be installed in salt-depleted areas or on marginal land. Buildings that have spacious roofs are some of the best places to install solar modules on a farm. Always discuss with your agricultural solar developer the best strategies that will fit your budget.

Benefits of Solar

The Benefits of Co-Locating Solar and Crop Production

An increasing number of agriculture businesses are looking to power their operations with solar energy. This is in no small part to the government’s interest in increasing solar investments across the country. Solar-powered farms around Illinois (especially near Chicago), Minnesota, Michigan, Indiana, Montana, Kentucky, Ohio, and beyond have started to become commonplace. If you’re wondering about the benefits of going solar while farming or owning an agriculture business, the experts at 93Energy are happy to discuss all your options.

There are a lot of benefits to co-locating solar and crop production, including:

- lowered installation costs thanks to pre-flattened land

- lowered risk upfront thanks to fewer geotechnical concerns

- lowered legal risks since agricultural sectors already have the right to “disturb” the land

- increased plant vegetation performance potential by better regulating soil temperature

- extend growing seasons

- lower water demands

- maintain crop production during poorer weather conditions

- market success with sustainably-minded customers

- increased opportunities to plant high-value crops that are shade-dependent

- lowered electricity costs

Financing

Bridge Loans

Bridge loans are a type of solar loan popular with customers who want to own their system but who need to manage the timing difference between installation and receipt of state and federal incentives. Since solar incentives in Illinois can account for more than 60% of the cost of a system, this type of loan allows customers to go solar with considerably less up-front investment.

Term Loans

A term loan is similar to mortgage. The term loans most frequently chosen by our customers have a 20-year term, but we also offer 15 and 10 year loans. This type of solar loan is great for customers who want to minimize the out-of-pocket cost of going solar but who still want to take advantage of the long-term economics of solar ownership. The payments on these loans can be smaller than the savings on utility bills that result from going solar.

Solar Lease/Power Purchase Agreement

Just as with an automobile lease, with a solar lease you don’t actually purchase your solar system—you make payments for the right to use it over a period of time. The solar leases we offer are provided by SunPower, our equipment manufacturer, and have terms of 20 years. Solar leases are great for consumers who want to immediately save money on their energy costs but who prefer not to invest in their system. Solar leases are also ideal for customers who don’t have a federal income tax liability and thus can’t take advantage of the federal tax credit for solar. Solar lease customers do not receive the federal tax credit or the Illinois Shines incentive, but rather benefit from those incentives through a lower monthly lease payment than they would otherwise receive.