The Investment Tax Credit (ITC) remains one of the most powerful incentives driving the adoption of solar and energy storage in the U.S. To help developers, businesses, and partners maximize the benefit, the IRS has issued updated Safe Harbor rules that clarify how projects can qualify.

At 93Energy, we want to ensure you understand what these changes mean for your projects—and how to position your pipeline for success.

What Is ITC Safe Harbor?

The ITC Safe Harbor provision allows solar and energy storage projects to secure eligibility for tax credits by demonstrating that construction has begun. This ensures that projects still qualify for incentives, even if completion takes several years.

Key ITC Safe Harbor Updates

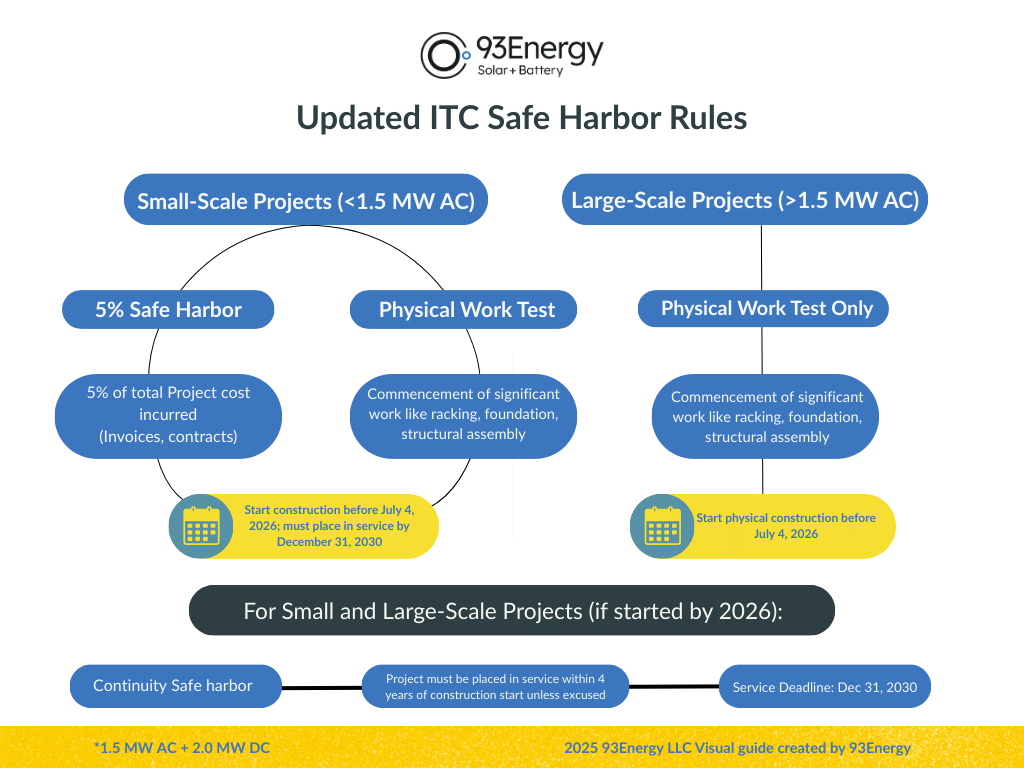

Small-Scale Projects (≤1.5 MW AC)

These projects now have two paths to qualification:

- 5% Safe Harbor – By incurring at least 5% of total project costs (invoices/contracts).

- Physical Work Test – By beginning significant construction activities like racking, foundation, or structural assembly.

Deadlines:

- Start construction before July 4, 2026.

- Must be placed in service by December 31, 2030.

Large-Scale Projects (>1.5 MW AC)

For projects above 1.5 MW AC:

- Only the Physical Work Test applies.

- Construction must begin before July 4, 2026.

Continuity Safe Harbor (all projects)

- Projects must be completed within 4 years of starting construction (unless exceptions apply).

- Final deadline: December 31, 2030.

Why These Rules Matter

These updates give developers more clarity and flexibility when planning projects. Whether you’re working on a distributed commercial & industrial system or a utility-scale solar project, aligning with Safe Harbor milestones ensures you:

- Secure the maximum ITC benefit.

- Reduce compliance risks.

- Improve financial certainty for investors and stakeholders.

How 93Energy Helps Developers Succeed

At 93Energy, we partner with developers, EPCs, and businesses to ensure projects are designed and delivered with policy compliance and performance in mind. Our team helps you:

- Plan projects around Safe Harbor deadlines.

- Optimize designs to maximize ITC benefits.

- Integrate solar + storage for long-term value.

Let’s Secure Your ITC Benefits

The updated IRS Safe Harbor rules create a clear roadmap for solar developers. Now is the time to evaluate your pipeline and make sure your projects are aligned.

👉 Schedule a consultation with 93Energy to discuss how these ITC updates impact your timelines and ensure your projects capture the full incentive value.